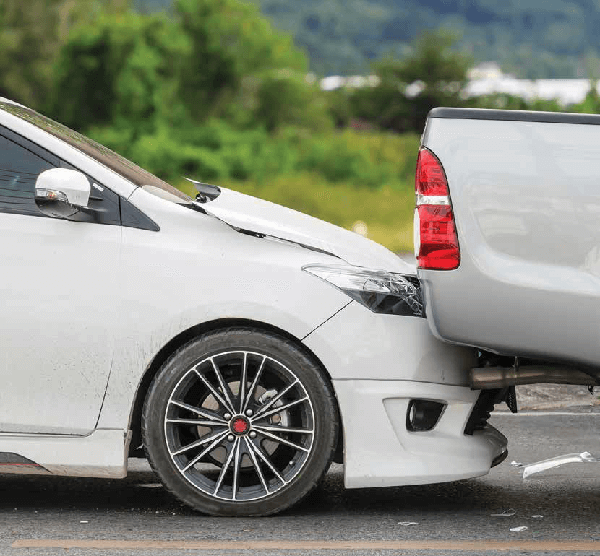

Is comprehensive insurance on a vehicle really worth it?

We know what you’re thinking, because we have thought it ourselves, is it really worth paying for insurance on my car on the slight chance I get into an accident? The answer is a resounding, yes!

Before we get into why we recommend having insurance, we will give a quick explanation of the different types of insurance you can take out on your vehicle:

FULL COMPREHENSIVE INSURANCE

This is the most extensive insurance you can take out on your vehicle. This will cover you, whether the cause of the accident was through your fault or another driver. If the other driver caused the accident, your insurance will repair your vehicle.

If you were the cause of the accident, it will repair your vehicle and repair the other driver’s vehicle. This insurance also covers damage to your vehicle caused by weather events or theft for example and even compensates you for damage to personal items within the vehicle.

THIRD PARTY INSURANCE

This insurance covers you for any damage you may cause to another vehicle. This will ensure that you are not held personally liable for the damage.

OTHER INSURANCE

Each insurance provider has different miscellaneous insurance cover. This type of insurance cover includes Classic or Unique Car Insurance, Small Business Insurance and Motorcycle Insurance. You should contact your preferred insurance provider to discuss which insurance is right for you.

WHY DO WE RECOMMEND HAVING INSURANCE?

We regularly receive calls from people who have been involved in accidents but do not have comprehensive insurance. Unfortunately, this involves us having to tell them that if you want to recover any money for the repairs to your vehicle, you will need to sue the other driver in Small Claims Court. In Queensland this is known as the Queensland Civil and Administrative Tribunal (QCAT), or in the Magistrates Court.

Both of these options involve significant costs and do not guarantee recovering any money from the other driver. This is the age old expression of “throwing good money after bad”.

If you are involved in an accident which was not your fault, and neither you nor the other driver has insurance, your only recourse to recover the cost of repairing your vehicle, is from the other driver directly.

The other driver may, out of the kindness of their heart, pay you for the repairs. However in our experience this is rarely the case. If they ignore, or refuse to pay, your options are to commence legal proceedings against them. Again, there is no guarantee that even taking this step will result in your vehicle being repaired.

If, on the other hand, the accident was your fault, you may find yourself receiving letters from the other driver demanding you pay for the repairs to their vehicle. Even worse, you may be woken up one morning by a process server serving you with Court documents.

These are the exact reasons why we strongly recommend comprehensive insurance. Not only to ensure your vehicle is repaired, but also to protect you should another person’s vehicle need to be repaired. For those of you who carry tools in your vehicle, or those who are self-employed, it is even more important that you take out comprehensive insurance on your vehicle. If your vehicle is damaged or written off in an accident that was caused by another driver, not only would you be left without a vehicle to travel to work, but your tools may also have been damaged and therefore unusable. Again, your only right of recourse is against the driver directly.

Unfortunately, you may never recover any money for the damage. However, if you were to be comprehensively insured, your vehicle would be repaired by your insurer (or you would be paid the value of your vehicle) and you may receive compensation for the value of your tools, depending on the insurer and any limits they have on compensation for personal property.

BUT WHAT ABOUT THE COST?

We understand that insurance can be expensive, however, what you are really paying for is peace of mind.

Let’s say you are involved in an accident and the accident was your fault. Let’s say the other driver is a self-employed tradesman and has a Ute full of tools. You would be liable for the cost of repairing their vehicle (or the cost of the value of the vehicle), plus the replacement cost of all of their tools, plus the cost of repairing your vehicle (or replacing it), plus the cost of replacing your own tools. This could easily amount to over $20,000.00. This would be a disaster.

If comprehensive insurance is too expensive, at the very least, we would recommend taking out Third Party Insurance. This will ensure that you are at least protected, should you cause any damage to another vehicle.

Additionally, under some Third Party Insurance policies, if you are involved in an accident with an uninsured vehicle, and the uninsured vehicle was at fault for the accident, your insurer may cover you for some of the damage to your own vehicle.

Some insurance companies offer up to $5,000.00 to assist you with your own repairs if an uninsured vehicle causes damage to your vehicle.

FURTHER INFORMATION

For further information, we would recommend contacting the different insurance companies to see what insurance is right for you.